Whenever an initial-day homebuyer hears the definition of mortgage, they won’t usually view it given that an item. The idea they could research rates for example appears uncommon – actually financing degree based on the exact same requirements? The truth is that the purchase price and terms of a mortgage are often negotiable and you may are very different lender of the lender. Actually, homebuyers that simply don’t comparison shop shell out an extra $three hundred far more annually and you can plenty moreover the life out-of the fresh loanparison hunting actually unusual, it is a necessity – especially just before including a significant union.

Review looking for a mortgage isn’t popular. With respect to the Individual Economic Safety Bureau, merely 30% out of American individuals glance at several financial for a good financial. In the next ten years by yourself, its expected you to definitely Millennials are set buying 10 mil the new home. That it wave out of first-big date homebuyers means of numerous homeowners have a tendency to overpay for their mortgages.

Since you research rates to have home financing, listed here are the facts to consider and also the mistakes to stop since you safer an affordable price and glamorous terms and conditions.

Just why is it Vital that you Research rates to possess a mortgage?

Prior to beginning the process of review searching, a small framework can assist. I don’t have an elementary group of rules otherwise even offers certainly one of every mortgage lenders. Each bank kits its underwriting guidelines, charge, and rates of interest. Summary: You may find a better handle that lender than just with some other.

To start, you need to look for a lending company that offers a great interest rate. Modifying rates possess a good compounding impression over the years as well as good slight improve eg 0.5 percent costs a great deal of currency along side life off financing. It is in addition crucial to remember that interest rate sort of issues as well. An adjustable-rates financial will get go up at some point in the mortgage title while increasing the monthly payment. Fixed-rates loans by comparison wouldn’t transform.

There are even additional factors that may determine your choice beyond rate of interest. Look at the following the whenever assessment searching lenders:

- Things. Fees which have a relationship to your rate of interest. Constantly, the greater amount of items you pay, the low the rate.

- Charges. Various costs for example mortgage origination and you can underwriting costs, representative fees, etc. Most people are negotiable.

- Settlement costs. The costs regarding the closure your loan. The lender or broker have to have an estimate for people who inquire them.

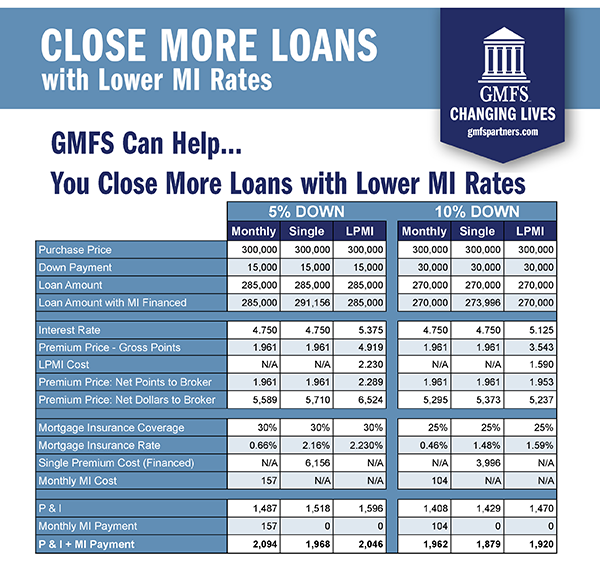

- Down payment. Some lenders need 20%, even if anyone else may require only 5%. Less down-payment will most likely wanted individual home loan insurance coverage (PMI).

- Personal mortgage insurance coverage. PMI is an additional prices added to your own financial to safeguard the lending company in the event of borrower standard if loan off percentage are lowest.

When you have questions regarding what you would qualify for, you could demand a lender physically concerning the information on the fresh financial.

It’s More than simply Interest levels

Before you could meet with loan providers, it is best to get ready. Inquiring best issues (hint: they should meet or exceed interest rates) enables you to learn the very concerning your choices. All the questions listed here are a beneficial starting point.

- Do you really communicate with members physically, otherwise courtesy text, characters, otherwise calls? How fast can you operate?

- What bank fees have always been I accountable for on closing? Can any end up being waived or rolled on the home loan?

- The length of time is the mediocre turnaround time for pre-recognition, assessment, and you may closing?

- Does purchasing discount things to down my personal price add up?

- Which are the downpayment conditions?

When you yourself have the appropriate information, you can build an informed decision and pick the mortgage that is right to you personally.

How can you Find a very good Mortgage lender?

An easy search on the internet is the easiest way to obtain loan providers. Even though, you should never underestimate inquiring relatives, members of the family, otherwise realtors because of their pointers. Furthermore, scout to possess lenders with a high feedback. In the event that other homebuyers getting surely regarding their knowledge of the lender, they’ve been a much better applicant than just some other which have worst recommendations.

Remember people rates the thing is that on the internet are merely estimates – you are able to spend much more based your role. You can use your quest because the influence when settling the home loan costs that can improve your probability of picking out the cheapest mortgage to you.

Along with, inquire for every financial from the serious currency put. Really mortgage brokers need this first off the loan process, and you will significantly less than specific activities, might return it. If they can’t identify people items, you really need to search in other places.

Before you Talk with Loan providers

Earliest, remark your credit report – Equifax, Experian, and TransUnion legitimately should provide a totally free backup of one’s declaration immediately following all 1 year. When the you will find people affairs on the statement, you need to take care of those in advance of contacting lenders.

2nd, comment the different particular mortgages to see which is best for your finances. From conventional funds to regulators-recognized money like FHA and you may Va in order to focus-merely mortgages some other crossbreed and you will specialty brands, you should have an abundance of alternatives when you shop to. Along with, decide if you need an adjustable-rate home loan otherwise a fixed-speed mortgage.

As you assess the certain financing, think about that will perform best for you. A keen FHA financing may appeal to your using its restricted down percentage and credit history conditions, or if perhaps you’re an experienced otherwise energetic-obligation servicemember, following a Va loan may notice your. There isn’t a single-size-fits-most of the provider.

If you Check around having home financing?

Yes https://paydayloancolorado.net/centennial/ – evaluation finding home financing can mean more income on your pocket. Start by some elementary browse and you will keep in touch with loan providers. Once you have a foundation of thought and thinking, possible be positive about the decision and you can save some costs in the process.