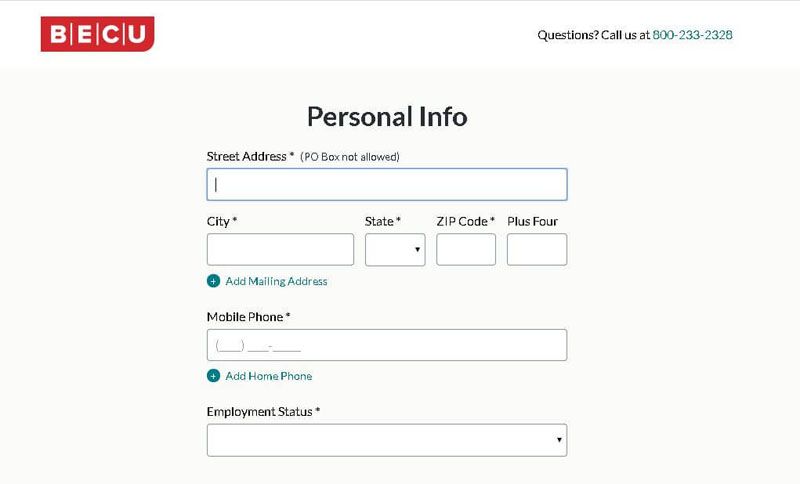

step three. As well, streamlined software commonly involve simplistic variations and forms, making it easier to possess individuals to provide the necessary data. Eg, in the place of manually filling in a long time versions, consumers might have the choice to complete an online app, where advice might be inserted and you may submitted electronically. This besides conserves big date in addition to decreases the risk of errors otherwise destroyed advice.

4. Instance studies have shown one to smooth application process can rather expedite the mortgage acceptance schedule. By detatching so many papers and simplifying the applying techniques, lenders can be feedback software more effectively, decreasing the big date it requires to get a decision. This is exactly eg very theraputic for consumers that happen to be seeking secure a home loan easily otherwise have enough time-sensitive and painful a residential property transactions.

– Assemble all the necessary documents in advance: Even if streamlined apps wanted fewer data files, will still be vital that you have got all the absolute most files in a position. With these data offered, you can expedite the application form process further.

– Double-check your application to have precision: If you’re smooth programs are designed to end up being much easier, its crucial to make certain all the info your provide is appropriate. Take time to remark your application meticulously just before submission it.

– Communicate on time along with your lender: If the financial requires any extra suggestions otherwise data, act americash loans Lehigh Acres promptly on their demands. Timely correspondence will help stop any way too many delays and continue maintaining the fresh new app procedure on the right track.

A streamlined software techniques offers numerous masters for consumers looking to an effective home loan. By eliminating documentation, simplifying versions, and you can expediting the fresh new recognition timeline, candidates can help to save work-time and energy. Following the guidelines offered and you can understanding the benefits associated with an effective smooth app, you can browse the borrowed funds application process more effectively and you may secure your dream household at some point.

step 3. Getting rid of Appraisal Costs and you will Expenditures

step one. No longer appraisal fees: One of many significant benefits associated with a no appraisal mortgage are this new removal of appraisal charge and expenses. When getting a vintage financial, individuals are expected to pay money for an expert assessment so you’re able to determine the value of the home. This will pricing from a couple of hundred to a few thousand bucks, depending on the dimensions and you will difficulty of the home. not, with a no assessment financial, this rates is completely eliminated, making it possible for borrowers to save a lot of currency from the beginning.

Errors or discrepancies may cause delays if you don’t financing denials

2. Savings with the assessment-related expenses: Plus the actual appraisal percentage, you can find tend to almost every other expenses associated with the brand new assessment processes. Including, borrowers could need to purchase a home check, that can prices multiple hundred cash. They may should also coverage any requisite solutions otherwise renovations recognized within the appraisal, which can soon add up to several thousand dollars. By eliminating the need for an appraisal, borrowers can also be stop this type of even more costs and sustain more cash in the their pouches.

3. Example: Consider a hypothetical circumstance where a borrower is to acquire a beneficial possessions worth $3 hundred,000. Inside a classic mortgage, they might generally speaking have to pay to $five-hundred to have an assessment payment, and additionally a supplementary $400 getting a property assessment. In case your appraisal relates to any needed fixes well worth $5,000, the complete expenses regarding the appraisal create add up to $5,900. But not, that have a zero assessment financial, the latest borrower can help to save that it whole number, making homeownership cheaper and you may accessible.

cuatro. Methods for improving economy: If you’re considering a zero assessment home loan, here are a few tips to help you optimize your prices savings:

A. Search loan providers: Not all the loan providers render zero assessment mortgages, it is therefore necessary to search and you will examine more lenders to get the most suitable choice for your needs. Find loan providers whom are experts in these mortgage loans and you may bring competitive rates.