$500k Household Mortgage payment

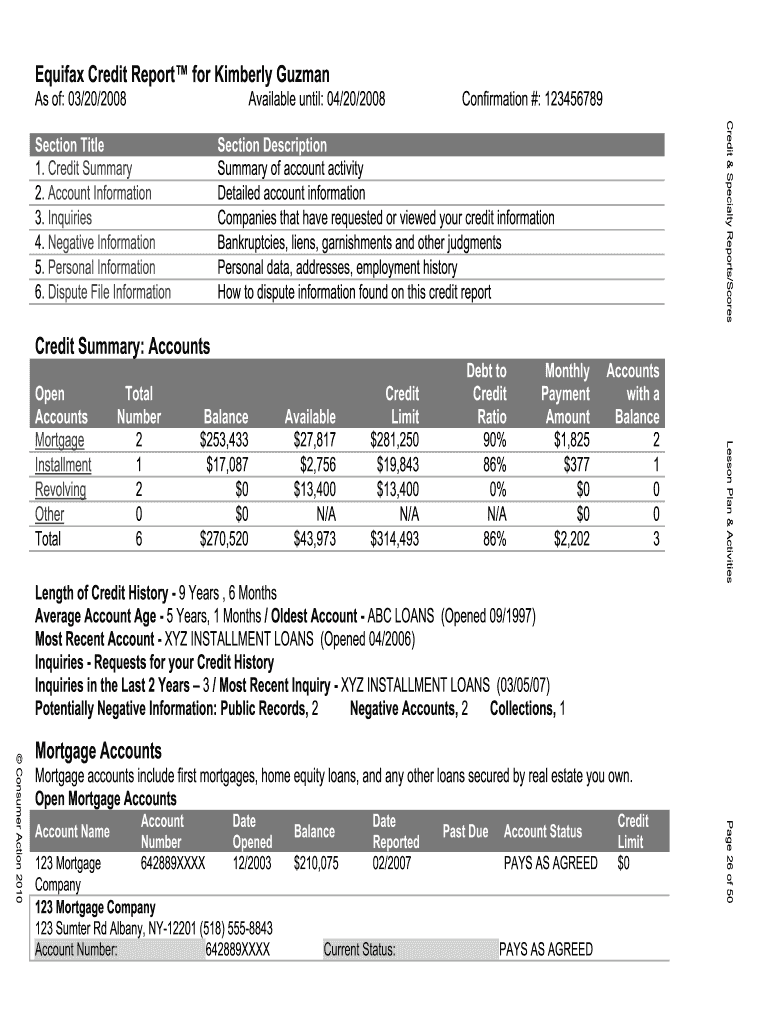

Brand new month-to-month mortgage repayment to the an excellent $five hundred,000 mortgage are very different according to interest you could safe, that can believe their borrowing and you will income. An average rate of interest having a thirty-season repaired-rates financial is just about 7.2%. So, for people who could safer it price to the full 20% down-payment, your month-to-month homeloan payment would-be $2,715.

Money Required for an excellent $500k Mortgage

Really experts recommend not purchasing more than twenty eight% of your own money into the a home loan fee. Thus, in order to easily pay the monthly payments, you must make on the $ten,000 per month (otherwise $120,000 a-year). Although not, you can acquire away that have proving less income when you yourself have a top credit history or if you can make a much bigger down-payment.

If you would like afford the mortgage off shorter, you can like a fifteen-seasons repaired-price mortgage, that will require a payment per month away from $step 3,640 which have a 20% advance payment and you can an effective seven.2% rate of interest. not, you might likewise require an income around $155,000 so you’re able to meet the requirements, nevertheless manage avoid spending extra focus over the years.

$500k Family Repair and Fix

You will additionally wish to be certain to plan for repair and you will repairs. Given that direct will set you back will vary with respect to the size and you will location of the property, certainly one of other variables, most it is strongly recommended budgeting on the 1-2% of your own cost a year to cover maintenance and repairs. So, getting good $five-hundred,000 home, you should cut regarding the $5,000 to $ten,000 a year.

$500k Home Taxation

Taxation can be a serious concern which can will vary founded towards the condition you reside. Says such New jersey, Illinois, and New Hampshire feel the high possessions income tax pricing, when you’re Hawaii, Alaska, and you will Colorado have among reasonable. The common effective property taxation price in the us is actually step 1.1%, which may imply a yearly costs of approximately $5,500 getting a $five hundred,000 home, nevertheless shall be higher or all the way down depending on the state.

So you can easily pay for a good $five hundred,000 home, your websites value are going to be anywhere between $150,000 so you can $250,000. Very loan providers should notice that you really have no less than 3-6 months away from living expenses saved to arrange to possess emergencies. The actual number you ought to help save is determined by the lives however, might be as much as $twenty five,000 so you’re able to $fifty,000. It can also help tell you almost every other money channels, such local rental services, financing membership, and you can top organizations. This may tell you the financial institution you to even if you stop working, you still have a reliable cushion or other cash source so you’re able to fall straight back into.

hash-draw

If you loan places Boone feel confident in your capability to really make the financial repayments, up coming to shop for an effective $five hundred,000 house is a smart financial support. The common home speed in america is $436,800, definition of a lot People in america might possibly be wanting land value $500,000 or higher. Yet not, never use the risk otherwise getting confident in your debts otherwise what you can do to expend the mortgage. You might be better off deciding on lower starter house otherwise renting for some time your improve your problem. The worst thing for you to do is get into over your face and you can find yourself going into property foreclosure because that get ruin your upcoming prospects for homeownership.

hash-mark

To find good $500,000 house is a possible objective for most people. Although not, you must be familiar with all of the associated can cost you before you can start your search. To invest in a property is a major commitment and needs ongoing economic debt past just the mortgage payment. So be sure to simply take a difficult look at your profit and make certain you can afford the costs before applying for an excellent loan.