Caroline Bundy Fichter, a business attorneys towards the Bundy Law practice of Washington, estimates you to she pertains about a third away from the woman franchisee website subscribers in order to case of bankruptcy attorney-and most of those obtained SBA fund.

Which is one of the troubles inside the franchising. Most people put money into companies thinking its secure than doing a concept from abrasion, yet it falter just as will.

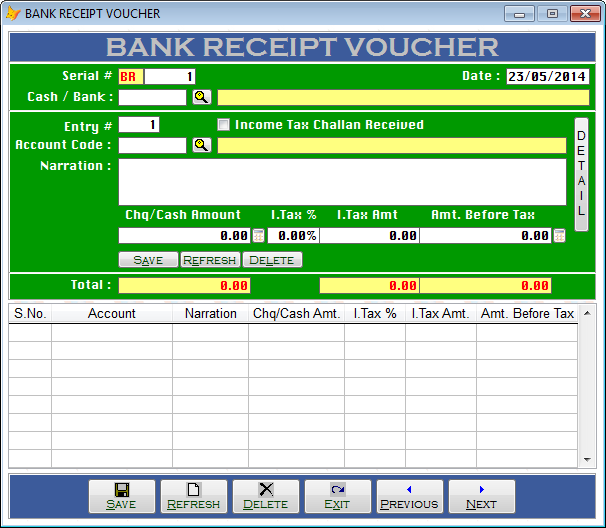

2021 SBA seven(a) funds

While you are there are various really-shown and strong names having franchisees searching SBA loans, for example Domino’s and Jersey Mike’s Subs, there are many built to systems where difficulties work on rampant. Many franchises promote aggressively to anyone prepared to indication a contract. They might and additionally deploy other steps that make it harder to have providers and then make a return.

The new SBA will minimize lending so you can franchises with unnecessary downfalls, as it at some point performed having Burgerim. Nevertheless might take a bit, if this actually goes. Quiznos signed as numerous franchisees as it can certainly in early 2000s, ultimately to get the nation’s next-biggest sub strings. Yet , additionally had among industry’s highest costs from default towards SBA loans. Franchisees reported loudly regarding the a number of things, rather high charges for food and paper.

The company first started closing gadgets from the various in ’09. Now this has less than 5% of one’s cities it had on the peak from inside the 2006.

The fresh SBA at the one-point composed default rate research to own franchises whose franchisees acquired such as for example finance. However the institution eliminated this about ten years ago. Which makes it harder to decide exactly how much franchisees inside the a brandname are having difficulties.

Cortez Masto last year delivered an expenses who require the SBA to share quarterly default prices to your financing because of the brand name more than the latest preceding ten-12 months several months. She and additionally reintroduced regulations that would want team owners discover historical cash and shop closing guidance in advance of capable found an enthusiastic SBA loan.

The check this site out available choices of SBA loans in addition to decreased visibility to your default investigation provides some body an opportunity to gamble with other man’s currency, Bundy Fichter said. People who are harm ultimately certainly are the franchisees in addition to taxpayers.

What’s more, she said, it may be difficult at best to own borrowers away from SBA loans to get vacation trips. Whenever you are landlords otherwise franchisors might provide recommendations getting striving franchisees, this new SBA rarely really does.

SBA 7(a) financing because of the seasons

Burgerim theoretically launched the very first location on You.S. during the 2016. It licensed more step 1,five hundred franchisees by the end out-of 2019. The condition of California prices this type of workers paid nearly $58 billion into the franchise charge.

The fresh FTC said within the lawsuit submitted a week ago the team intentionally distorted the risks of business to those customers-together with guaranteeing refunds, all of the it never ever offered. It absolutely was the 1st time the service got action facing an excellent business in the fifteen years.

The newest SBA stays an open question. But really as part of Burgerim’s strategy to score stores launched, the business steered a lot of franchisees to the authorities-backed money.

Hackstaff provided to unlock an effective Burgerim in 2017, and then he try accepted having an SBA mortgage next seasons. He worked as a consequence of a broker therefore the company, and therefore managed every documents. Additionally they authored the business package this new SBA requires of any franchisee that provide the mortgage.

As part of the package was indeed monetary projections indicating the brand create getting successful their very first month, and remain effective thereafter.

That gave lenders rely on so you can Okay a rise in the shape of the financing from the fifty% to cover pricing overruns on the buildout, a common issue to own Burgerim franchisees that have been capable of getting that far.