A different chance is you, your house buyer, safety the additional will set you back one exceed the loan financing. There was a high probability you’ll have to cover the expense away from up front, meaning dollars, in case your down payment is just too reduced or if zero deposit was getting paid down anyway.

Then there is this new sacrifice between visitors and you may seller to-break the fresh even more will cost you just as. Thus, in our scenario in which an additional $10,000 is owed, the seller would reduce the cost by the $5,000 and visitors will make within the most $5,000.

Negotiate the brand new accessories

Along with this type of options, there are many an easy way to reduce the price of the house. It is prominent getting household sellers to incorporate equipment and you may/otherwise furniture to your business, including the costs on the total price. Regrettably, Va appraisers would not become this work should be to gauge the value of your house versus along with one thing inside. Choosing to allow the client contain the products is also reduce steadily the total price of your own financing instead of switching the worth of brand new home.

Alternatively, leave

If there’s absolutely no way in the reasonable Virtual assistant appraisal, then you needs to be prepared to walk off on the contract. Va appraisers was professionals, and they have become authoritative by Virtual assistant to check on homes. In the event that manufacturers are unwilling to move or your Real estate agent dont work away yet another price, it may be in the client’s best interest to get a great other family. It is really not the happiest regarding endings, nevertheless would be worthy of to avoid higher, out-of-wallet costs only to get the specific domestic.

An excellent Virtual assistant appraisal was a critical part of the homebuyer procedure having pros. This new pledge is that you stumble on no issues and you may sail effortlessly to closure. But some Va buyers tend to deal with assessment troubles.

Solutions bought

The fresh new Department off Pros Situations makes it necessary that all the features satisfy a a number of Lowest Possessions Criteria. That it record is designed to ensure that experts is actually moving into property that will be safe, sound and you may clear of any life style risks.

Unfortunately, specific homes cannot satisfy such very first requirements. With that, the newest Va appraiser could possibly get acquisition repairs before closure can occur.

Whether your assessment returns with purchased fixes, it is essential to likely be operational to your supplier. Pose a question to your real estate professional to share the list of called for solutions. Tell them that you’re not able to move ahead that have your house buy except if these types of solutions is actually completed, due to the constraints of the Va mortgage. Sometimes, the seller commonly comply easily towards repairs otherwise discuss a good the newest price one things about fixes having a smooth closing.

In case the vendor is actually reluctant to complete the solutions, next good Va homebuyer will not be able to go give into the pick.

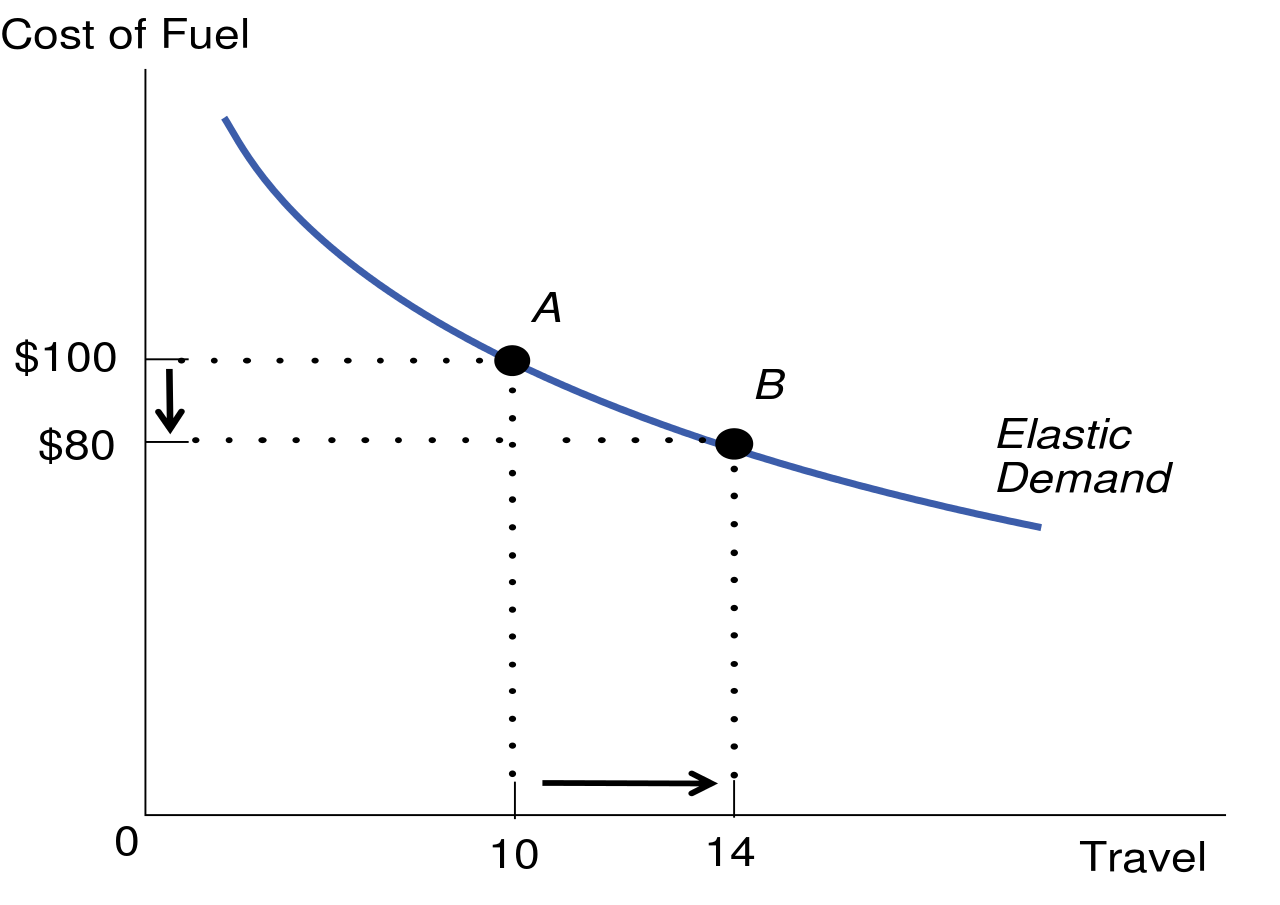

Lower assessment worthy of

Brand new timely rate of economy function some house may feel appraised reasonable. For folks who discover a reduced assessment, you can request a good Reconsideration of value in the Virtual assistant.

If the reconsideration doesn’t impact the assessment well worth, settling with the merchant getting a better price is a choice. But in a trending markets, most manufacturers might be unwilling to exit any cash toward dining table.

If this happens, you’ve got the choice to compensate the real difference within the cash. However, that ount to help you extra cash than available for you. You may have to walk away from the marketing if you’ve tired all your valuable options.

How to prevent Va family assessment affairs

Va appraisals aren’t while the complicated while they may sound. You can find early cues homeowners will find to tell in the event that an excellent domestic tend to clear an assessment or not. Here are some ideas for more information on how best to avoid Va appraisal things from 255 payday loans online New Mexico bad credit inside the property processes.