Current Mortgage Words: Consumers may inherit any existing things otherwise cons for the amazing home loan, including prepayment charges or unfavorable words.

Faqs regarding the Assumable Mortgages

Asking about assumable mortgages usually brings out numerous queries. Customers and you may providers the https://paydayloanalabama.com/sylvan-springs/ same look for clarity to the processes from assumable mortgages, the qualification standards, and you can potential benefitsmon concerns revolve within process of incase good mortgage, understanding the ins and outs regarding home loan assumable terminology, and you may whether specific funds, such as for instance assumable price mortgage loans, are advantageous in today’s business. Solutions to such Faq’s shed light on brand new feasibility regarding deciding to possess assumable financing, this new measures with it, while the possible downsides. Hence, a comprehensive comprehension of assumable mortgages is extremely important having told decision-while making for the home deals.

These may are expectation fees, settlement costs, and you can potential changes getting interest levels or the stability. Facts these types of expenses is very important for folks offered of course a home loan, ensuring advised decision-and also make inside a house purchases.

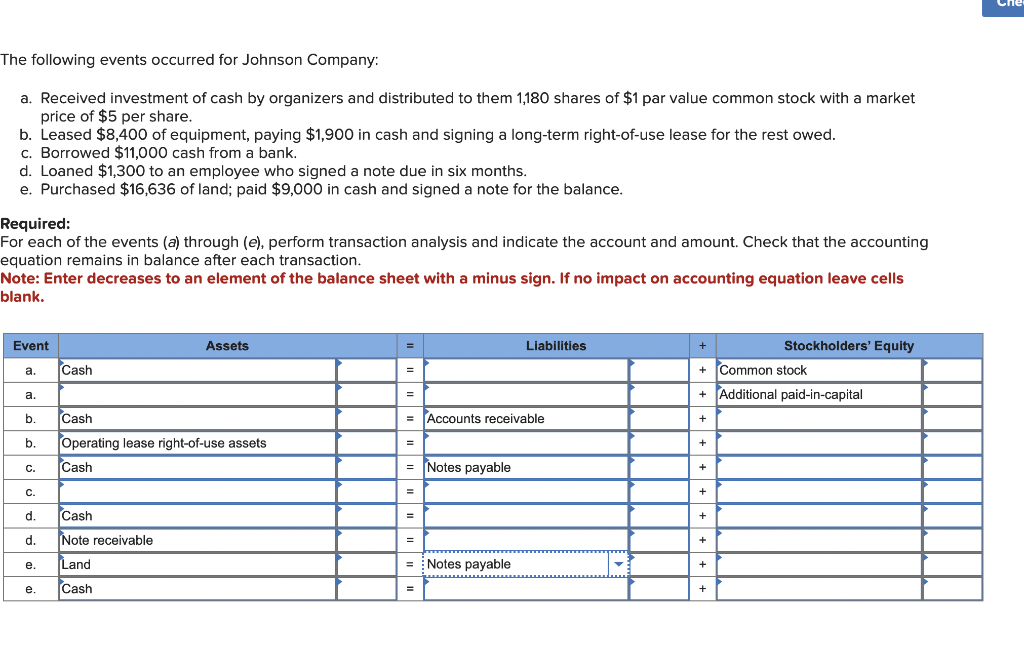

Just how to Qualify for An Assumable Home loan

Possible buyers must meet lender standards, along with creditworthiness, money stability, and you will possibly a deposit. Information this type of certificates is the vital thing for these seeking assumable funding, guiding all of them from application process and you will increasing its probability of securing the necessary mortgage.

Was an Assumable Home loan A great?

When you find yourself assumable mortgages offer benefits including advantageous interest rates and you can smaller settlement costs, they may also come that have constraints like strict acceptance processes and inheriting established financing conditions. Evaluating private financial desires and markets criteria is very important into the determining if an assumable mortgage aligns with a person’s demands, making certain a highly-advised decision within the a house ventures.

Given that mortgage pricing is actually significantly more than 6%, taking on somebody else’s straight down-rates loan should be a terrific way to save on notice.

Assumable mortgage loans will be the mechanism which allows you to accomplish that: When you guess a home loan, you may be basically picking right up the prior owner’s financing, with the same interest rate and terminology, once you purchase their home.

It’s a pretty uncommon flow, for the highest region once the not totally all brand of mortgages meet the requirements getting expectation. In addition to, they usually requires that the customer built a lot of cash in the course of purchase to cover number off collateral owner has yourself.

Mortgage presumption are going to be difficult and also their cons, however the prospective reward – a lesser rate of interest – causes it to be worth every penny.

How come an enthusiastic assumable mortgage really works?

Homeowners have a tendency to imagine and in case mortgages whenever rates of interest regarding the market is actually greater than they were during the a recent period. Men and women may be the direct housing industry requirements we have been inside now, which includes brought about an increase of interest inside assumable mortgage loans. Centered on Western Banker, the quantity of assumptions grew from the 67% between 2022 and 2023.

Even after that growth, will still be a niche product, because the government-recognized fund are the only mortgage loans entitled to be believed. Fannie mae and you can Freddie Mac financing – nearly a couple of-thirds of the financial sector – are ineligible.

The main mark regarding an assumable loan ‚s the capability to safe a lower price than just you would score with a new financial, which can lead to high coupons.

But assumable mortgage loans are not a selection for many customers because of the necessity for a large bucks percentage towards seller. (Consumers will often have to pay owner the essential difference between new financial harmony as well as the income price of the home.) Additional factors which can allow it to be a beneficial nonstarter include an extended schedule to shut, reduced numbers of authorities-backed mortgage loans in a few locations and also the problem out-of distinguishing them.