Later-lifestyle mortgage loans was unique borrowing products on oldest portion from homeowners. Santander’s choices within this classification are typically characterised by the a lot more lenient financing criteria and you can designed information meet up with the unique needs away from older individuals.

For those over sixty trying remortgage, Santander will bring chances to renegotiate the new terms of a preexisting mortgage or even change to a special security release package which could become more favourable because of the current rates of interest and you can financial requirements.

The Character from Loan providers, Advisors, and you may Brokers into the Santander Collateral Launch if you want to release money

Lenders such as for instance Santander play a crucial character in the collateral release procedure. They offer the fresh financial products that loan places Nauvoo enable earlier homeowners to get into the brand new guarantee in their residential property. Advisors and you will brokers act as intermediaries, providing guidance with the intention that the new picked security discharge package best fits the fresh new homeowner’s demands.

Variety of Collateral Launch getting Earlier Borrowers which have Ranged Borrowing from the bank Records

Santander understands that more mature borrowers possess diverse borrowing records. While you are a no-credit-check plan isnt fundamental, Santander, like many lenders, can get showcase a more nuanced way of borrowing histories, recognising the value of the house plus the borrower’s collateral for the it.

Brand new Determine out-of Fiscal experts to the Equity Discharge Behavior do you need a great collateral discharge adviser?

Fiscal experts, together with people such Martin Lewis, who is recognized for their focus on money-saving information, commonly weigh-in on the subject of guarantee discharge. The information will likely be important to own people offered whether or not to discharge collateral from their homes.

Santander’s Guarantee Discharge Markets Standing an informed guarantee discharge supplier?

Due to the fact a critical player in the monetary qualities industry, Santander’s entryway towards collateral release sector signifies the latest broadening pros of them circumstances having home owners. Having a selection of alternatives for older consumers, Santander offers accessibility the latest wealth fastened within their property, that will promote even more financial liberty when you look at the old-age.

Having Santander Lender the fresh security release rates try minimal once the security release information is free and most organizations charge to ?1500

Residents need certainly to cautiously imagine the choice to enter towards the a security release agreement, taking into consideration new a lot of time-title financial implications, the new affect their house, and you will any possible change on the entitlement to state pros. Tools eg guarantee release calculators and advice away from financial specialists is offer rewarding understanding of whether or not products like Santander’s RIO mortgage loans otherwise interest-just mortgage loans is actually an audio financial move.

Information Lifestyle Mortgage loans and you may Pensioner Mortgages Shared Application

To own older residents in the united kingdom, lifetime mortgages and pensioner mortgage loans render an approach to availableness the fresh new security within homes. Such borrowing products shall be for example used in people with bad credit, as mortgage are safeguarded from the worth of your house, reducing the lender’s exposure.

Equity Launch and extra money How it functions

Guarantee launch function opening the value tied up on the property instead of attempting to sell it. There are two main an effective way to accomplish that: life mortgage loans and domestic reversion preparations. Existence mortgages are definitely the popular style of security release, enabling you to borrow money against your property while sustaining ownership. Household reversion plans include attempting to sell element of your residence in return to own a lump sum or typical income.

Financing so you’re able to Well worth (LTV), arrangement commission and you can Valuation to have later lives home loan solutions

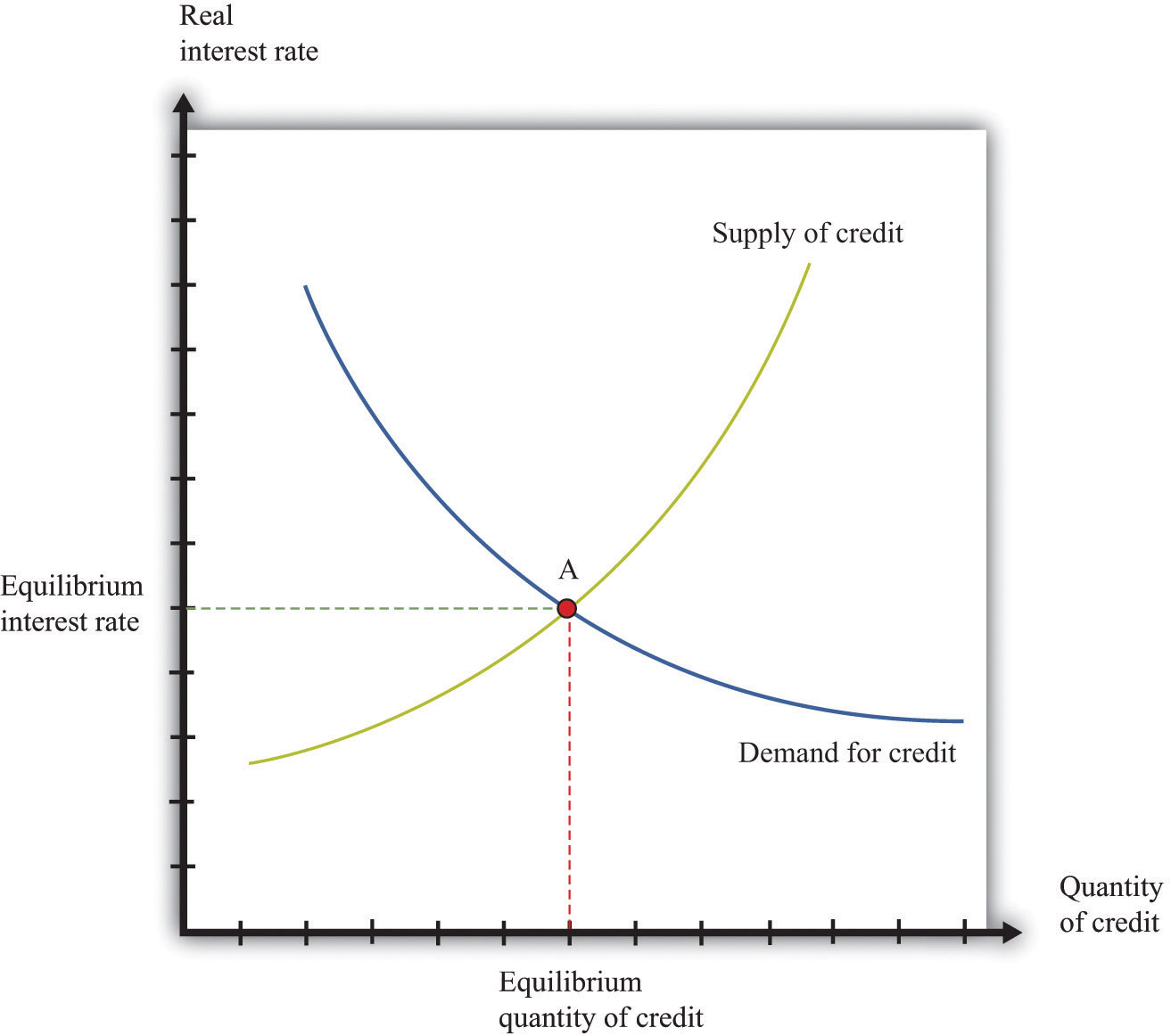

The mortgage-to-worthy of (LTV) ratio find just how much you can obtain. Which ratio compares the value of your property towards overall amount you need to obtain. An expert valuation in your home will determine their current market really worth, and therefore has an effect on brand new LTV ratio. Straight down LTV percentages fundamentally cause finest conditions minimizing appeal prices.