Mortgage Software Assertion: Understanding the Grounds

Receiving an assertion to suit your home loan application will likely be disheartening, but it’s important to comprehend the known reasons for the option within the purchase when planning on taking compatible action. Whether your financial software program is denied, the lender gives you a mortgage assertion letter that teaches you the reasons towards assertion in addition to credit rating department used to check the job . This page serves as a kick off point to own expertise as to why your software was not approved and just what activities to do so you’re able to address the issues.

Assertion Letter Reason

The borrowed funds assertion letter is actually a composed factor provided by the brand new financial, discussing the specific explanations the job is actually declined. It can outline elements one to influenced the decision and you can section out one aspects of question on your own software. The letter will additionally indicate the financing reporting company your bank regularly look at the job. Knowing the articles from the letter is extremely important getting determining the new requisite tips to alter your qualification to possess a home loan.

Well-known Reasons for having Mortgage Denials

Mortgage denials can occur a variety of reasons, and it’s vital that you be aware of the most typical issues conducive to help you app rejections. Here are a few of regular things about financial denials:

Of the knowing the reasons for the financial assertion, you could potentially take compatible step to handle the issues and increase your odds of coming home loan acceptance. It is critical to just remember that , different loan providers might have varying conditions, so it may be valued at examining choice credit institutions and looking their great tips on how exactly to alter your mortgage qualification.

Taking action Immediately after a home loan Denial

Finding home financing assertion are discouraging, however it is very important not to ever give up hope. There are many things you can do to deal with the issue and alter your probability of protecting a mortgage later on. A couple key actions to adopt once a home loan assertion are contacting the loan officer and you may examining alternative home loan choice.

Getting in touch with Your loan Administrator

When your financial software program is refuted, its crucial to reach out to the loan administrator for additional clarification. Capable render valuable knowledge to your reasons for the assertion and show you to the potential areas for improve. The Bankrate states you to definitely loan providers generally topic home financing denial page, that explains the causes on the denial as well as the credit rating service always evaluate your application. Of the discussing such causes with your loan officer, you might get a better knowledge of this facts one triggered brand new assertion.

With this discussion, you may want to explore an easy way to improve your financial qualifications in the future. The loan manager can offer suggested statements on ideas on how to address the recognized issues, instance boosting your credit history, lowering your debt-to-earnings ratio, or providing a lot more documents to verify your earnings and you will work balances. It direct communications also provide valuable guidance and place your for the your way into the providing acknowledged for a home loan on future.

Examining Alternative Financial Solutions

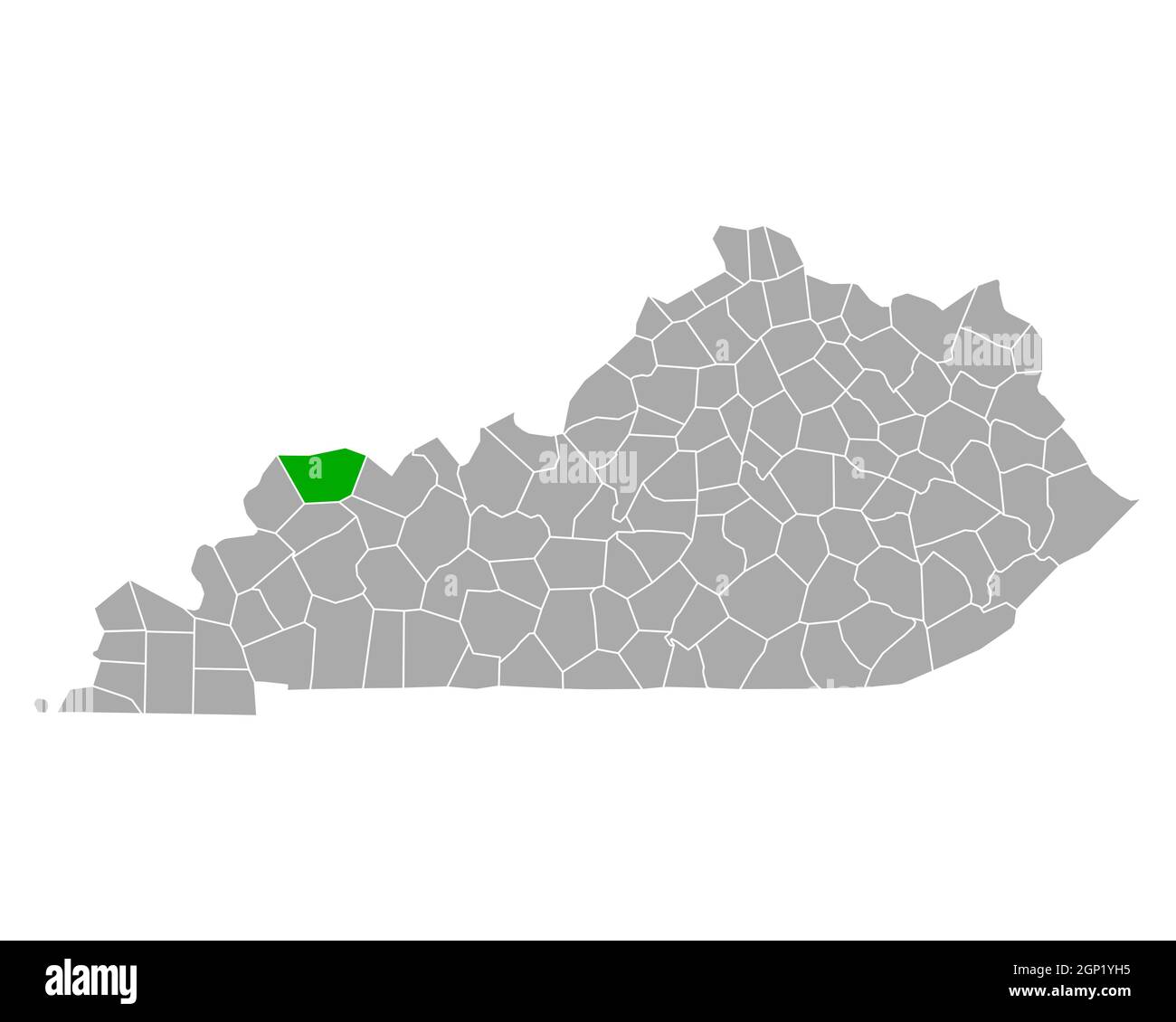

installment loans online in Kentucky

If for example the initially home loan software is refuted, this doesn’t mean the termination of your own homeownership goals. There might be option financial options available you to greatest suit your financial situation. Experian suggests discussing all types of mortgage loans together with your financing officer. Particularly, if you were declined getting a conventional loan, you could talk about regulators-supported alternatives such an FHA financing.

These types of alternative apps may have various other qualifications requirements otherwise bring more independency in some portion, instance credit score standards or deposit wide variety. From the exploring these possibilities, you could potentially probably come across a mortgage you to aligns greatest with your newest financial affairs. Your loan administrator also provide tips about the fresh new qualifications criteria and you may advantages of these types of alternative home loan applications.