If you’re considering using a keen FHA loan to get a home, you have read which they want mortgage insurance rates. You might also become wondering if FHA home loan insurance policies shall be got rid of after you have hit 20% equity in your home, like with a traditional (otherwise non-government-backed) mortgage.

The latest quick response is, it depends. If one makes a deposit off step three.5%, like any individuals exactly who play with FHA funds, that you will find to blow yearly mortgage insurance into longevity of the mortgage. In this case, the FHA mortgage insurance can not be eliminated, even although you arrived at 20% collateral.

Although not, if you make a down payment out-of 10% or higher while using an enthusiastic FHA loan, the brand new annual mortgage insurance could well be canceled immediately following 11 age.

Note: The above statutes apply at FHA buy fund particularly (i.elizabeth., people utilized by home buyers). The fresh Streamline Re-finance program has its own band of guidelines, to be secured into the a different article.

2 kinds of FHA Financial Insurance policies

FHA mortgage brokers try covered of the national, underneath the handling of the fresh new Institution of Property and you can Metropolitan Development (HUD). Therefore it is the federal government that decides all recommendations and needs because of it system.

One of their needs would be the fact individuals exactly who play with a keen FHA mortgage must pay for financial insurance coverage. In reality, there are 2 more premiums individuals need to pay.

- The latest Initial Home loan Advanced (UFMIP) means 1.75% of the ft loan amount. That is a-one-date fee you to definitely, despite its title, is rolled on the financing money and you may paid off throughout the years.

- Brand new Annual Mortgage Advanced (MIP) can vary according to the regards to the borrowed funds. For most consumers which explore an enthusiastic FHA financing having an excellent step three.5% down-payment, brand new yearly home loan cost concerns 0.85%.

Referring to in which one thing score a bit complicated. Specific borrowers are able to cancel the annual FHA financial insurance coverage just after eleven years, and others is actually stuck with it into lifetime of the borrowed funds. The difference has to do with what kind of cash you put down.

With an advance payment off ten% or maybe more, the borrowed funds-to-worth (LTV) proportion is equivalent to or lower than 90%. In this instance, consumers which have an enthusiastic FHA loan may have its annual financial insurance rates terminated after 11 ages.

That have a down payment lower than 5%, the loan-to-really worth proportion turns out are more than 95%. In this situation, HUD needs consumers to blow FHA yearly mortgage insurance coverage for the lifetime of the loan.

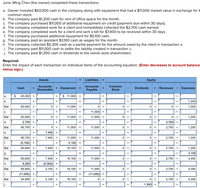

This new desk lower than is duplicated regarding HUD Manual 4000.1, the official assistance toward FHA mortgage program. The newest table suggests the new yearly MIP termination choice (or run out of thereof), based on the certain mortgage parameters.

It’s worth listing at this point that almost all house consumers which play with a keen FHA financing create a down payment lower than 5%. Actually, here’s what pulls these to the application form in the first place.

The brand new FHA financial program lets individuals making a downpayment as low as step three.5%. As a result, this method lures homebuyers who possess limited financing stored right up to the 1st initial financing.

This is why, really FHA borrowers generate a downpayment less than 5%, which means that he’s a primary LTV ratio greater than 95%. As you can plainly see on table above, this means they might need to pay FHA annual financial insurance policies to the lifetime of the borrowed funds (or even the home loan term in community jargon).

Will it be Terminated otherwise Removed at the 20% Collateral?

You might’ve heard one certain residents who have mortgage insurance can be obtain it canceled when they visited 20% equity or possession in their home. That is real, it generally relates to old-fashioned mortgages.

The word conventional means home financing that’s not backed or protected by authorities. Quite simply, antique and you will FHA mortgage loans are two different things totally.

When using a conventional financial, with a keen LTV proportion higher than 80% typically needs personal mortgage insurance policies. But that is totally distinctive from government entities-expected financial insurance coverage you to definitely applies to FHA money.

While doing so, residents which have a conventional mortgage usually can has actually their PMI coverage canceled when they come to 20% collateral in their home. Stated in another way: Capable terminate their financial insurance coverage in the event that mortgage-to-worth ratio drops so you’re able to 80% or less than.

You have the straight to request that your particular servicer cancel PMI for those who have hit new date when the principal equilibrium off your own mortgage is defined to fall so you can 80 percent of brand spanking new value of your property.

But it 20% code usually will not affect FHA financing. Even if you might terminate the new annual financial insurance policies towards a keen FHA mortgage keeps far more regarding the size of the advance payment, as opposed to the guarantee height you may have in your home.

Of course, one may refinance out-of a keen FHA financing and you may to https://paydayloancolorado.net/maybell/ your a normal financial at a later time. Therefore that is a different way to get off this new FHA yearly MIP bills. Just remember that traditional loans can also wanted home loan insurance coverage, particularly if the loan-to-worthy of proportion goes up a lot more than 80%.

Breakdown of Tips

We shielded many guidance in this post. Thus let’s wrap up which have a summary of an important takeaway situations you should think of:

- Question: Can FHA financial insurance go off on 20% equity?

- There are 2 categories of mortgage insurance coverage assigned to FHA funds – upfront and you will annual.

- The newest initial superior (UFMIP) usually number to a single.75% of one’s feet loan amount.

- Brand new annual superior (MIP) for the majority of consumers which play with FHA funds involves 0.85%.

- Although annual MIP can vary, based on the advance payment matter and the loan identity otherwise length.

- Individuals just who lay out 10% or maybe more can usually enjoys their FHA MIP cancelled after 11 many years.

- Individuals exactly who make an inferior down payment (below 5%) normally have to invest FHA annual financial insurance coverage into lifetime of the financing.

Disclaimer: This informative article provides an elementary report about FHA financial insurance rates termination guidelines, considering certified guidelines provided by the fresh Agency of Casing and you can Metropolitan Creativity. Home loan financing scenarios may vary from 1 debtor to the next. Thus, servings of the blog post will most likely not affect your position. For those who have questions otherwise concerns about the subject, i remind that contact new FHA otherwise speak with an effective HUD-recognized lending company. You are able to relate to HUD Manual 4000.1, which is available online.